Power your application with our customizable closed-loop payment system

Experience the power of seamless payments with our API-based closed-loop solution, designed to easily integrate into your payment system. Flexible. Secure. And built to meet your needs.

How our closed-loop payment solution works

Integrate our API

Quickly embed SwiftPay’s payment API into your app with ease, supported by detailed developer documentation for a smooth setup.

Customize for your brand

Personalize the design and features to align with your brand. Provide a seamless and branded experience to your customers.

Manage payments

Instantly accept, process, and track payments directly within your app with full transparency and control.

Monitor and optimize

Monitor transactions in real-time with intuitive dashboards to optimize your service and drive business growth.

Transforming businesses across various industries

Retail & e-commerce

In-app purchases & rewards programs:

Integrate our closed-loop payment system into your payment proces to streamline checkout processes, store loyalty points, and offer rewards to frequent buyers, all within a single platform.

Benefits:

- Enhance user experience with faster checkouts

- Drive loyalty through rewards and cashback

- Full control over transaction data and payment flows

Education & e-learning platforms

Course payments & student wallets:

Offer a wallet or card to your students to pay for courses, learning materials, or services like cafeteria payments and book purchases in a closed-loop ecosystem.

Benefits:

- Unified payments for tuition, materials, and services across campus

- Reduce reliance on external payment gateways

- Enable recurring payments or subscription models for students

Event management

Ticket sales & cashless transactions:

Leverage our closed-loop payment system for ticketing, and managing payments for food, beverages, or merchandise at your events, all within a single platform.

Benefits:

- Simplify payments for all event-related services

- Reduce transaction fees and waiting times for users

- Offer loyalty points for repeat event-goers

Hospitality & travel

Hotel payments & travel credits:

Offer seamless hotel bookings, room upgrades, service payments, and redeemable travel credits—all within a single closed-loop payment system.

Benefits:

- Faster payments for hotel services or upgrades

- Encourage repeat bookings through travel credits and rewards

- Simplified in-app payments for users across global locations

Transportation & mobility services

Cashless Rides & Subscription Payments:

Let your passengers store funds for cashless payments and enjoy a smoother travel experience within your network. Manage payments and subscriptions under one account.

Benefits:

- Fast and easy payments for frequent riders

- Enable faster and smoother boarding or ride access

- Simplified management of multiple service payments

Gaming & entertainment

In-Game Purchases & Virtual Currencies:

Offer in-game currency, simplify microtransactions for virtual goods, and facilitate in-game purchases within your ecosystem with lower transaction fees.

Benefits:

- Fast, secure, and seamless in-game purchases

- Retain control over in-game economies

- Enhanced player engagement based on their behavior

Healthcare

Patient Payments & Health Plans:

Provide a closed-loop wallet or card for managing payments, insurance claims, and even health savings plans. Allow users to pre-load funds and use them for treatments, medication, or services.

Benefits:

- Streamlined payments for patients without using external systems

- Simplified billing and insurance claim processes

- Efficient tracking of healthcare spending

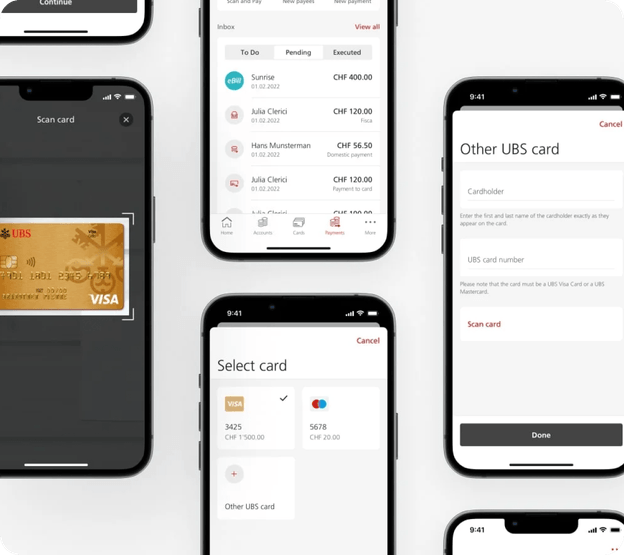

Fintech & payment providers

Peer-to-Peer Transfers & Digital Banking:

Enable your users to send and transfer money within your ecosystem. Offer digital wallets or cards for managing funds, and add virtual banking features without relying on external providers.

Benefits:

- Reduced transaction costs

- Secure and fast peer-to-peer transactions

- Extend banking-like services without building from scratch

Discover the power of SwiftPay

Advanced security for every transaction

PCI-SSF Compliant

Our platform adheres to global security standards like PCI-SSF to ensure your app meets compliance for secure transactions.

Fraud Detection

Detect and block fraudulent transactions with our system’s robust security algorithms to safeguard your business and customers.

Data Encryption

Ensure the privacy of all sensitive financial information for all payments with end-to-end data encryption.

What you can achieve with SwiftPay.Guru

Startups build on Stripe to launch faster, adapt as they grow, and automate workflows to do more with less. Build your own API-based integration or use our low- to no-code solutions, which are simple enough for easy implementation and powerful enough to scale as fast and as far as you need.

Seamless integration

Our open API allows you to embed a fully functional closed-loop payment system into your platform with minimal effort. Get up and running quickly to enhance user experience without any complex technical difficulties.

Complete control over transactions

Manage transactions within your ecosystem efficiently and securely. Our closed-loop system ensures that funds stay within your network, which reduces costs and gives you full control over payments and user data.

Customizable and scalable

Tailor our solution to meet your specific requirements. Whether you're looking for loyalty rewards, in-app purchases, or peer-to-peer transfers, our solution grows with your business and adapts to your evolving needs.

Built-in security

We prioritize security at every step. From encrypted transactions to secure user authentication, our closed-loop system is designed to protect your users and your business from fraud and data breaches.

Transform the way you handle payments

Maximize engagement, reduce transaction fees, and take full control of your payment ecosystem with SwiftPay’s closed-loop payment solution.

News, blogs and insights

Discover all the latest news, trends, and insights pertaining to on-demand businesses through our well-crafted content.

Frequently asked question

A closed-loop wallet is a digital payment solution that operates within a specific ecosystem, allowing users to make payments only within the brand's own platform. This gives businesses greater control over transactions, user experience, and associated fees.

Using a closed-loop wallet with an open API offers the following benefits:

- Full Control: Businesses can manage payment workflows, data, and user experiences.

- Customization: You can customize the wallet to match your brand and application.

- Cost Efficiency: By avoiding external payment processors, you can reduce fees.

- Enhanced Security: Transactions happen within your ecosystem, which reduces the risk of fraud.

Our API is designed to be developer-friendly with comprehensive documentation and SDKs. Depending on the complexity of your app, integration can take anywhere from a few hours to a couple of days.

Security is a top priority. Our wallet features end-to-end encryption, PCI-DSS compliance, two-factor authentication, and built-in fraud detection systems to ensure all transactions are secure.

Yes, our closed-loop wallet is fully customizable. You can modify the UI/UX, branding elements, and transaction workflows to match your brand’s identity and user experience.

We offer extensive API documentation, SDKs, a sandbox environment for testing, and a dedicated support team to assist with any technical challenges during integration.

Yes, we offer a sandbox environment and the option to request a demo so you can explore how the solution works before going live.