Payment systems keep evolving to meet the demands of modern consumers. And businesses no longer just wants to accept payments; they want to build a connection with customers so that they keep coming back.

Closed-loop payments can handle both–modern customers’ preferred payment options and the need for businesses to provide some value or reward. This aspect of closed-loop payments makes it ideal for many businesses across different industries.

Let’s have a look at some data:

-

By 2026, over 5.2 billion people—more than 60% of the global population—are expected to use digital wallets. (Juniper Research)

-

Nearly two-thirds of consumers (64.8%) see payment speed as a top priority when choosing how to pay. (Banked Ltd.)

Now, what does that mean? Customers are embracing the advanced payment technologies. And they are more likely to shop at the stores where transactions are processed quickly.

This is why businesses in many industries have opted for closed-loop payment systems. In this blog, we’ll explore five impactful applications of closed-loop payment systems and uncover how they reshape consumer behavior and drive business growth.

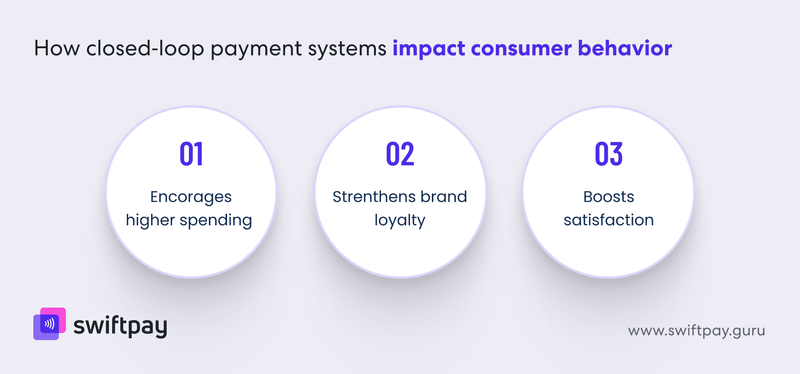

How closed-loop payment systems impact consumer behavior

Closed-loop payments can impact consumer behavior in several ways. Let’s see some noteworthy examples:

Encouraging higher spending through preloaded funds

Preloading funds into a closed-loop payment system instills a sense of readiness and ease for consumers. When funds are readily available, it allows them to focus on enjoying their shopping or service experience without worrying about immediate financial decisions. It turns spending into a smoother and more intentional process.

Strengthening brand loyalty with exclusive perks

Exclusive benefits such as member-only discounts, early access to sales, or premium services make consumers feel valued and appreciated. These perks are the biggest motivator for customers to stay within the closed-loop ecosystem. It also builds an emotional connection to the brand.

Increasing repeat visits through reward programs

Reward programs integrated into closed-loop wallets offer consistent and exclusive incentives for customers to return. This can include collecting points, discounts, personalized offers, or climbing loyalty tiers for better benefits. These systems are designed to make every transaction rewarding so that consumers feel a sense of achievement and appreciation.

5 most practical applications of closed-loop payment systems

Below are the five most practical and effective applications of closed-loop payment systems for businesses across various industries:

Retail sector: Streamlined in-store payments

If you think fast and hassle-free payments are just about convenience, then think again. Payments are the last part of the shopping journey, and hence they play an equally important role in creating a pleasant shopping experience.

When your customers can quickly check out using your store’s branded payment cards or apps, they feel valued and less stressed. You see how the mundane task of making payments can be so rewarding. Besides, integrated loyalty programs add a layer of emotional connection by rewarding your customers’ purchases. This makes them feel appreciated and eager to return.

For retailers like you, this means building trust and loyalty while ensuring your business's operational efficiency. With consistent payment tracking and synchronized inventory across channels, you can confidently manage customer demands. This helps you improve your own sense of control and preparedness.

Know more - Advanced Closed Loop Payment System for Retail Businesses

Hospitality and food services: Simplified guest experience

It’s no secret; in the hospitality sector, convenience can make or break a guest’s experience. It’s often a hassle for guests to pay for different services individually.

To overcome that challenge, hospitality businesses use closed-loop payment systems. These systems allow guests to pay for meals, amenities, and other services directly with their closed-loop card or wallet.

This flawless process makes them feel pampered, as they don’t have to worry about carrying cash or paying for services with different payment methods.

For businesses like yours, prepaid cards or integrated apps streamline payments. It creates a faster and more enjoyable experience overall. This improves customer satisfaction and also helps boost the confidence of your staff. Apart from that, there are fewer errors and delays. It’s a win-win: guests leave happy, and you enjoy smoother operations.

Know more - Closed Loop Payment System for Hospitality Businesses

Public transportation: Unified fare management

Public transport shouldn't feel like solving a complex puzzle. Closed-loop transit cards or wallets simplify this as they give commuters a hassle-free way to travel.

Whether topping up balances or tracking expenses in real-time, these systems make public transportation more reliable and stress-free. Commuters feel relaxed and empowered, as they know they can get where they need to go without delays or confusion.

For transit operators like you, these systems reduce the burden of manual transactions and streamline fare collection. Doing that brings a sense of pride for you as well because you are providing a better service. As a result, improved user satisfaction translates to increased ridership and revenue stability.

Know more - Closed Loop Auto Fare Collection System

Events and entertainment: Seamless transactions for attendees

Events and festivals usually have huge crowds and it is on organizers to make sure anything related to payments must be processed as fast as possible. Closed-loop wristbands or cards make this possible.

These systems let participants concentrate on savoring the experience without wasting time in waiting for payment approval. Quick and cash-free transactions alleviate frustration and allow them to feel fully engaged in the experience that they have come for.

For those organizing like you, the advantages are equally fulfilling. Close-loop payments make it easier for you to analyze the spending behaviors of attendees so that you can further improve your organization and management for your future events.

Moreover, the reduced necessity for manual payment processing enhances operational efficiency, whereas more seamless procedures create favorable experiences for attendees. All this contributes to strengthening your brand image.

Know more - Closed Loop Payment Solution for Event Management

Corporate ecosystems: Internal payment solutions for employees

In corporate settings, closed-loop payment solutions simplify day-to-day transactions, such as buying lunch or snacks at the office cafeteria or using vending machines.

For employees, this means fewer hassles and a greater sense of convenience. Preloaded wallets or closed-loop prepaid cards for business trips make expense tracking transparent and stress-free. This leaves them focused on their work instead of worrying about reimbursements.

For companies, streamlined payment processes reduce administrative burdens and encourage a positive work environment. Employees feel supported, and organizations enjoy smoother operations and improved morale. It’s an efficient way to boost satisfaction on both sides.

So, these are the most common applications of closed-loop payment solutions. However, these systems are not just limited to the industries mentioned above. Closed-loop payments can be incorporated into many more industries like education, tolls, parking, and healthcare to name a few.

Final thoughts

Each transaction in a closed-loop payment network becomes a precision tool for building deeper customer relationships, streamlining operations, and creating competitive differentiation.

And remember–your competitive edge is not only about processing payments. It's about changing every financial interaction into an opportunity. These systems do more than move money; they help you:

- Capture rich customer behavioral data

- Create personalized engagement pathways

- Turn routine transactions into strategic insights

Businesses like yours deserve a payment ecosystem that adapts, learns, and grows with your customers. The future of business isn't about transactions. It's about connections. Are you ready to move beyond simple payments and create an integrated and intelligent customer experience?

That’s exactly where SwiftPay can help you. Our experts will understand your business needs and can provide you with a solution that is tailored to your business and industry. Your next competitive breakthrough starts here.