Many businesses constantly seek ways to create deeper connections with their customers. Often, this is a big struggle. However, many advanced technologies are making it more and more easier for them to do that.

The way businesses collect payments often plays a crucial in how customers engage. Open-loop payments (or general-purpose payment systems) are widely accepted and they prioritize convenience across various platforms.

However, they limit opportunities for direct customer engagement. That’s where closed-loop systems can help businesses keep the entire transaction process within their ecosystem.

This approach allows businesses to overcome the challenges of disconnected customer interactions and focus on fostering deeper loyalty and personalized experiences. For those who aim to strengthen their brand and cultivate lasting customer relationships, closed-loop payment systems provide a compelling alternative.

These innovative solutions go beyond traditional transactions and offer a unique approach for businesses to build customer loyalty and streamline their operations.

Closed-loop systems represent a strategic tool that can transform how businesses like yours interact with your customers. They create a seamless and integrated experience that turns every transaction into an opportunity for engagement and brand building.

If you want to know more about closed-loop payment systems then you are at the right place. This blog will explore the following essentials:

- What closed-loop payment systems are

- How is it different from open-loop payments

- Benefits of closed-loop payment systems

- Business uses cases across numerous industries

Let’s start with the basics first.

What is a closed-loop payment system?

A closed-loop payment system works exclusively within a specified network. It acts as a self-sufficient financial environment. As opposed to open-loop systems such as Visa or Mastercard which are acceptable widely, closed-loop systems limit transactions to particular vendors or brands only.

If that sounds too technical, then let me help you understand it more simply.

Let’s say you are at a fair where you have to buy special “fair tickets” that you can only use inside the fairground. You can't use these tickets at the stores near your house or anywhere else outside the fair. They only work at the fair's rides, game booths, and food stands. That’s exactly how a closed-loop payment system works for your customers.

What is it?

A closed-loop payment system is like having a special TV streaming service subscription - think of it as Netflix. Now you know that Netflix shows only work on Netflix, you can't watch Netflix shows on cable TV. So, similarly, closed-loop cards or wallets only work within their own specific system. For example, you can't use Starbucks app money at McDonald's.

And how is it different from regular payments?

Again, consider regular payments – cash or credit/debit cards – as a universal remote control. It works with almost any TV. But a closed-loop payment is like the remote that came with your TV - it only works with that specific brand and model.

Difference between closed-loop and open-loop payments

There are several differences between closed-loop and open-loop payments. Let’s go through it one by one:

Usage flexibility

Closed-loop payments function within a designated network. It is usually ideal for brand-focused ecosystems. On the other hand, open-loop payment systems allow consumers to make transactions at various merchants, such as grocery stores, restaurants, e-commerce platforms, etc.

Transaction fees

Open-loop systems often involve third-party transaction fees, which can add up for businesses like yours. However, closed-loop systems typically eliminate such fees. In this particular aspect, it is a cost-efficient solution.

Control over data

Closed-loop systems grant business owners like you full ownership of customer data, which you can use to do better analysis and provide personalized engagement. Open-loop systems, on the other hand, involve intermediaries who control most of the customer data.

Customer focus vs. broad reach

Open-loop payments are widely accepted, which means more flexibility and freedom for consumers. However, closed-loop systems are mainly implemented to build strong brand loyalty by catering to repeat customers.

Real-world example of a closed-loop payment system

Oyster cards used for public transport across the city of London in the UK are one of the best examples of a closed-loop payment system. It allows passengers to pay for rides within the transportation network.

How closed-loop payment systems work

A closed-loop payment system begins when a customer loads funds or connects a payment method to a proprietary app, card, or wallet account. These funds remain in the network, and any purchases made stay within the brand's ecosystem.

Step-by-step process:

-

Preloading funds: Customers transfer money to a prepaid card, mobile wallet, or app linked to the business. For example, a gift card purchased at a retail chain can be used across all its locations.

-

Transaction exclusivity: Payments occur solely within the designated ecosystem (as explained earlier). For instance, it could be a branded app for a quick-service restaurant.

-

Data flow and fund management: Businesses keep payment and customer data internal, which helps streamline operations and enhance security.

Technological tools like QR codes and NFC ensure smooth transactions. For example, a quick scan of a QR code at a checkout counter or restaurant table can instantly process payments. This saves time for both customers and staff. Another example is when customers use funds from their NFC wallets (in smartphones) or cards to pay at any merchant.

Key benefits of closed-loop payment systems

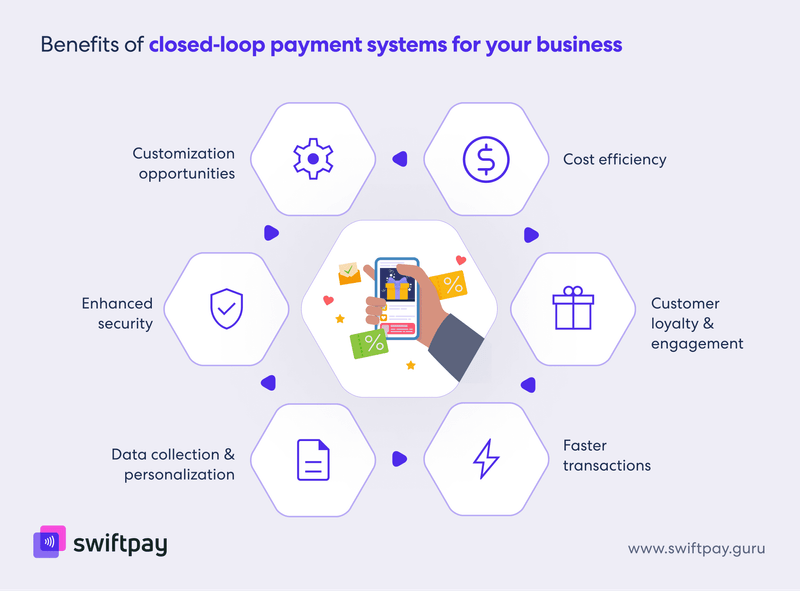

Closed-loop payment systems offer numerous benefits to businesses like yours. Let’s explore the key benefits that you can have with it as a business:

Benefits to businesses

Cost efficiency

Businesses like yours can save on third-party transaction fees with a closed-loop payment system. This allows you to reinvest in customer-centric initiatives. For instance, implementing an exclusive app with integrated payments will reduce reliance on credit card networks.

Customer loyalty and engagement

Closed-loop payment solutions encourage your customers to stick with your brand as they receive exclusive rewards and discounts. Starbucks, for example, rewards its app users with points that can be redeemed for free items. This helps them drive repeat purchases.

Faster transactions

Closed-loop systems help you streamline payments. Hence, it reduces wait times and enhances customer satisfaction. A clear demonstration of this is how NFC wristbands at music events and concerts enable quick entry for attendees and let them make purchases within the event.

Data collection and personalization

With direct access to transaction data, businesses like yours can identify customer preferences, optimize inventory, and deliver targeted promotions. You can use this data to create personalized offers, which will help you boost your sales and profit.

Enhanced security

Since transactions occur within a controlled ecosystem in closed-loop payments, the risk of fraud or unauthorized use decreases significantly. Customization opportunities

Closed-loop systems allow you to tailor your existing payment systems to align with your brand’s identity, whether through mobile wallet design, loyalty & rewards features, or payment options.

Benefits to Consumers

Let’s see some stand-out benefits of closed-loop payment solutions that your customers will thank you for:

Convenience

Your customers can enjoy seamless and quick payments when using apps (mobile wallets) or cards designed specifically for your store or services.

Rewards

Loyalty programs integrated into closed-loop systems provide various tangible benefits for your customers, such as discounts, cashback, or exclusive offers.

Easy budgeting

Preloading funds can help your customers control their spending. This makes it easier for them to plan their shopping. It’s ideal for events or monthly allowances.

Security

Closed-loop systems limit exposure to potential fraud. Your customers are ensured peace of mind during transactions.

Business cases for closed-loop payment systems

Closed-loop payment systems can be implemented in stores across various industries. Let’s explore how businesses in different industries can leverage these systems to streamline payments, enhance customer loyalty, and improve overall operations.

Retail

Retailers use branded gift cards to retain customers and drive sales. For example, a department store can offer a reloadable card or mobile wallet for frequent shoppers, which can encourage repeat visits. Plus, it can also help retailers track the spending habits of customers for personalized promotions.

Read more: Advanced closed loop payment system for retail businesses

Event management

In events like music festivals or concerts, closed-loop payment solutions such as NFC wristbands remove the necessity for other payment methods. This allows faster transaction speed and plays a role in enhancing the experience for attendees.

Read more: Closed Loop Payment Solution for Event Management

Hospitality

Hotel chains can streamline their payments with a closed-loop payment system. This allows them to charge for all their services like dining, spa treatments, or other activities with a single card or mobile wallet.

Read more: Closed loop payment system for hospitality businesses

Transportation

Metro systems in many countries already use closed-loop cards for ticketing. These cards are periodical and can be loaded with funds. Such systems help streamline fare collection, reduce delays, and improve commuter experiences.

Read more: Closed loop payment solution for transportation businesses

Education

Many educational institutions implement closed-loop payment systems for on-campus transactions, such as in canteens or campus stores. Prepaid cards or mobile wallets assist students in financial management. Moreover, it also provides institutions with improved cash flow control.

Food and beverage

Restaurants and cafes can improve customer satisfaction by providing their own branded cards or mobile apps that store loyalty rewards or points. For instance, customers can enjoy early access to newly added items on the menu, which creates a sense of exclusivity and helps build loyalty.

Read more: Closed loop payment system for food & beverage businesses

Conclusion

It’s evident now that closed-loop payment solutions are a strategic tool for:

- Driving customer loyalty

- Improving efficiency

- Unlocking new revenue streams

Closed-loop payments find their uses in businesses across multiple industries. From retail and hospitality to transportation and education, businesses like yours can simplify payments and build lasting relationships with your customers.

You have already seen the numerous benefits of creating your own payment ecosystems for your business and your customers as well. Now it’s time to take the first step and explore how this innovation with SwiftPay.Guru is possible. Our experts will help you understand how you can reshape your approach to customer experience and business operations with our closed-loop payment solutions.